Mergers, Acquisitions, and Diligence

Navigating M & A with Data-Driven Diligence

Our Approach to M & A

Our diligence work prepares clients for key acquisition decisions and provides an independent assessment of achievable growth objectives. Tuscany conducts market and company diligence (both buy-side and sell-side) in acquisition transactions. Advance preparations, including extensive market assessments and forecasts, have yielded significant positive results for our clients in terms of enterprise valuation and investor commitments.

Tuscany supports deal execution through strategy validation, pricing evaluation, operational & sales diligence, asset separation analysis, communications management, and day one preparation.

Diligence engagements are conducted as an objective third-party voice in a transaction. Activities may include validation of market dynamics, key segment identification, quantifying short- and long-term trends, mapping the competitive landscape, and sizing growth opportunities. The depth of our reports is tailored to the needs of sellers or investors.

Description & Objectives:

Conduct market landscape analysis to identify highly attractive sectors for investment, define investment theses, and develop criteria to identify and vet prospective acquisition targets.

Typical Duration:

3–12 months (Depending on Client Objectives)

Typical Work Streams:

- Secondary research on trends, regulations, market size

- Market mapping

- Company benchmarking

- In-depth stakeholder interviews

- Tuscany led Workshops

Deliverable(s):

- Sector reports

- Market maps

- Criteria development

- Acquisition target lists

Fee Structure:

Fixed Fee or Retainer

Description & Objectives:

Lead and augment diligence efforts to:

- Quantify market size and identify key trends

- Evaluate seller management team

- Test and validate growth plan assumptions

- Pressure test firm’s ability to scale sales & marketing operations

Develop staging recommendations to execution plans

Typical Duration:

4 weeks (2–6 weeks)

Typical Work Streams:

- Seller management team interviews

- Pipeline and win/loss analysis

- Market sizing and landscape analysis

- Competitive Benchmarking

- Customer/rejector interviews

- Quantitative survey

Deliverable(s):

- Detailed report of key findings that address client objectives

30 day / 90 day / Year 1 staging recommendations

Fee Structure:

Fixed Fee or Retainer

Description & Objectives:

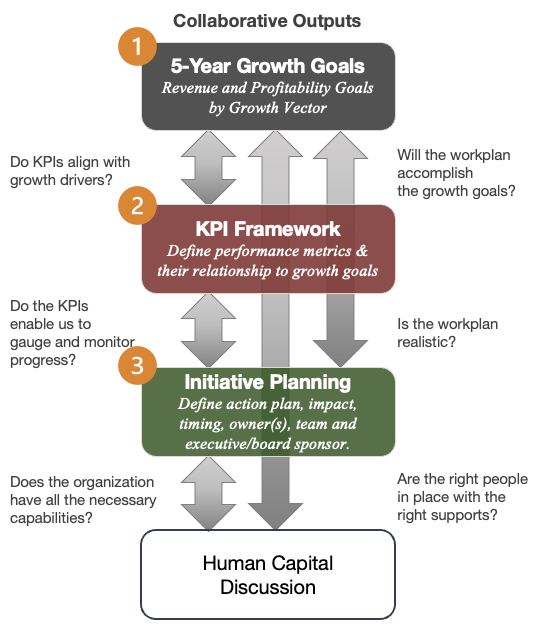

Crystallize short, medium, & long term initiatives. This is a highly collaborative strategic planning process with Vistria and the newly acquired operating organization(s). This is especially important for platform acquisitions. This process is designed to align multiple stakeholders around actionable five-year growth goals, KPI frameworks, and initiative plans.

Typical Duration:

2–4 weeks (Usually Pre-Close)

Typical Work Streams:

- Stakeholder interviews

- Management team workshop(s)

- Human Capital assessment discussions

- Pre-Read materials

Post-workshop reporting- Project planning

Deliverable(s):

- Strategic planning workshops

- Detailed record of key findings

- Staging recommendations

- Preliminary project plans

- KPI and initiative mapping output

Fee Structure:

Fixed Fee or Limited Retainer

Description & Objectives:

Enable and accelerate organic revenue growth through targeted projects including:

- Strategic planning

- Competitive intelligence & pricing

- Brand positioning

- Product portfolio analysis

- Sales/marketing optimization

Typical Duration:

2–4 months or retainer (Depending on Client Objectives)

Typical Work Streams:

- Sales & Marketing Operations

- Pricing

- Quality Assurance

- Customer, Defector, Rejector, Non-buyer research

- Product roadmap development

- Digital marketing assessment

Deliverable(s):

Discreet project deliverables and/or Execution Support

Fee Structure:

- Retainer for execution support

- Fixed Fee for projects